38 what does coupon rate mean

Statement on CFPBs Outline of Proposals Section 1033 Rulemaking Oct 27, 2022 · “ABA and our members fully support consumers’ ability to access and share their financial data in a secure, transparent manner that gives them control. Today, banks, data aggregators and other technology companies are collaborating to build tools that move away from less secure methods of data ... › playstation-userbasePlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft does not go into detail on its mental arithmetic here, but does note elswhere in its comments that PlayStation currently has a console install base of 150 million, compared to Xbox's ...

What does Coupon Rate mean? - YouTube Marketing Business Network 13.1K subscribers The coupon rate is the annual interest rate paid on a bond. It is represented as a percentage of the bond's face value. This video provides a...

What does coupon rate mean

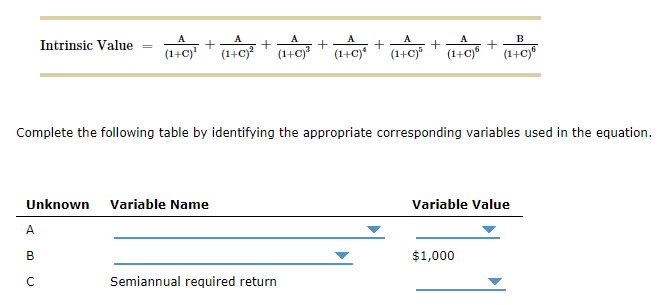

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security. Is the coupon rate the same as the interest rate?

What does coupon rate mean. What are coupons in treasury bills/bonds? - Quora Answer (1 of 12): They used to be actual additions to bonds printed on paper, representing the interest due at certain dates, so you could cut them from the bonds and present them for payment by the bond issuer. The nature of these financial instruments is that they generate interest payments at ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. PlayStation userbase "significantly larger" than Xbox even if every … Oct 12, 2022 · Microsoft does not go into detail on its mental arithmetic here, but does note elswhere in its comments that PlayStation currently has a console install base of 150 million, compared to Xbox's ... What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail. Linux - Wikipedia Linux (/ ˈ l iː n ʊ k s / LEE-nuuks or / ˈ l ɪ n ʊ k s / LIN-uuks) is an open-source Unix-like operating system based on the Linux kernel, an operating system kernel first released on September 17, 1991, by Linus Torvalds. Linux is typically packaged as a Linux distribution.. Distributions include the Linux kernel and supporting system software and libraries, many of which are provided ... Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet The coupon is the annual payment (s) an investor can expect to receive on a bond, expressed as a percent of the par value, which is also known as the principal. Coupon payments are made at regular intervals, usually a year, though for Treasury notes for example, the interval is six months.

› about-us › press-roomStatement on CFPBs Outline of Proposals Section 1033 ... Oct 27, 2022 · “ABA and our members fully support consumers’ ability to access and share their financial data in a secure, transparent manner that gives them control. Today, banks, data aggregators and other technology companies are collaborating to build tools that move away from less secure methods of data ... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of... time.com › nextadvisorHome | NextAdvisor with TIME Banking. What the Fed’s 0.75% Rate Hike Means for Your Money, and Why Now Is a Great Time to Save. The Fed just announced its sixth rate hike this year, sending interest rates higher than they ... Financial economics - Wikipedia Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy.

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Peter Thiel's gamble against the 'somewhat fake California thing' Oct 17, 2022 · If Masters and Vance win, so does Thiel’s vision for the GOP. It’s a vision of moving beyond the country club, NAFTA Republicans; it’s a more buttoned-up, competent version of Trumpism, capable of translating the former President’s blustery anti-establishment, anti-technocrat rhetoric into an actual social and economic program.

News and Insights | Nasdaq Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

The San Diego Union-Tribune - San Diego, California & National … Nov 01, 2022 · The nearly 100-year-old building has fallen into extreme disrepair and its owner was ordered to clean up and secure the site.

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

San Diego Union-Tribune - San Diego, California ... Nov 01, 2022 · The nearly 100-year-old building has fallen into extreme disrepair and its owner was ordered to clean up and secure the site.

PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Seventy-six percent rate the nation’s economy as “not so good” or “poor.” Thirty-nine percent say their finances are “worse off” today than a year ago. Forty-seven percent say that things in California are going in the right direction, while 33 percent think things in the US are going in the right direction; partisans differ in ...

What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with larger coupon rates are extra desirable for ...

Home | NextAdvisor with TIME Banking. What the Fed’s 0.75% Rate Hike Means for Your Money, and Why Now Is a Great Time to Save. The Fed just announced its sixth rate hike this year, sending interest rates higher than they ...

› news-and-insightsNews and Insights | Nasdaq Oct 07, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more

en.wikipedia.org › wiki › Financial_economicsFinancial economics - Wikipedia What remains to be determined is the appropriate discount rate. Later developments show that, "rationally", i.e. in the formal sense, the appropriate discount rate here will (should) depend on the asset's riskiness relative to the overall market, as opposed to its owners' preferences; see below.

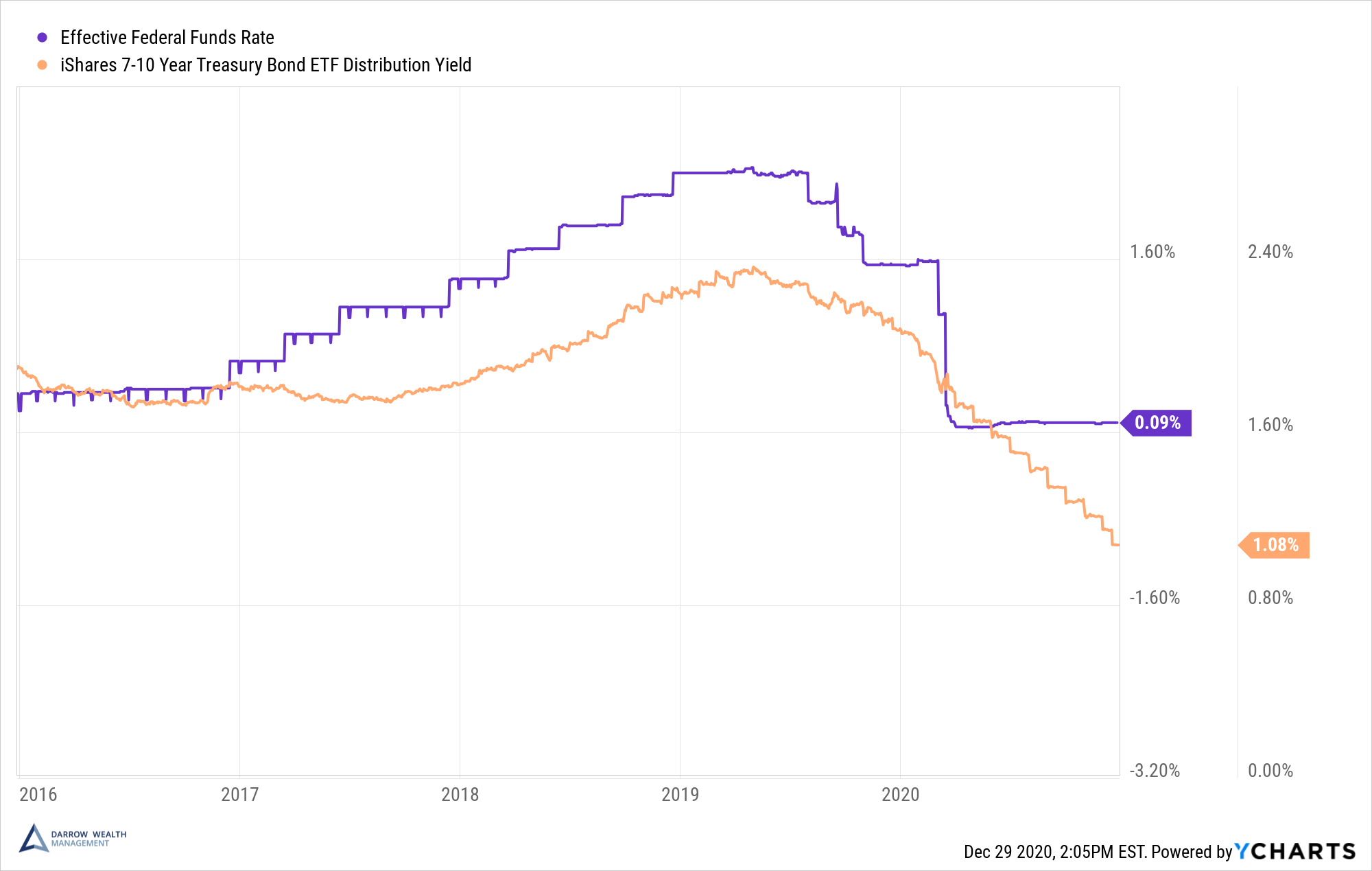

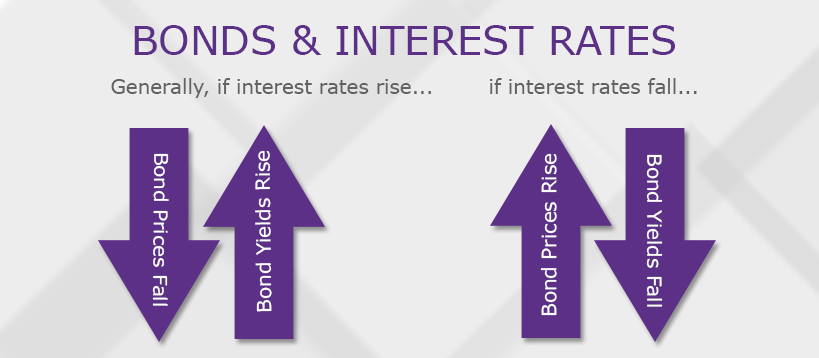

What is yield market? - Wise-Answer Coupon Rate: An Overview. A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. ... What does yield mean? What is a Yield. Yield refers to the earnings generated and realized on an investment over a particular period of time, and is expressed in terms of percentage based on the ...

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

What is a mortgage statement coupon? - KnowledgeBurrow.com The coupon rate is determined by adding the sum of all coupons paid per year, then dividing that total by the face value of the bond. ... What does it mean to have current coupon on MBS? As the underlying mortgages of MBSs have different interest rates, various MBSs will have different coupons. In the MBS market, a current coupon is defined as ...

What Does a Coupon Rate Mean? - oppitnews.com What Does a Coupon Rate Mean? Advertisement. Triston Martin. Aug 08, 2022. The nominal yield a bond is expected to pay at the time of issuance is known as the coupon rate or coupon payment. These fluctuations in value give rise to an increase or decrease in the cash's yield until maturity (YTM).

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate. Investors use the phrase "coupon rate" for two reasons.

Coupon-rate Definitions | What does coupon-rate mean? | Best 1 ... Define coupon-rate. Coupon-rate as a means The coupon rate is the rate of interest that is payable on a bond yearly. This rate is determined at the time the bond i....

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Microsoft does indeed offer platform perks Sony does not, and we can imagine those perks extending to players of Activision Blizzard games if the deal goes through. But Microsoft is also one of the world’s largest corporations, and praising such colossal industry consolidation doesn’t feel quite like the long-term consumer benefit Microsoft ...

› publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Seventy-six percent rate the nation’s economy as “not so good” or “poor.” Thirty-nine percent say their finances are “worse off” today than a year ago. Forty-seven percent say that things in California are going in the right direction, while 33 percent think things in the US are going in the right direction; partisans differ in ...

What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security. Is the coupon rate the same as the interest rate?

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value.

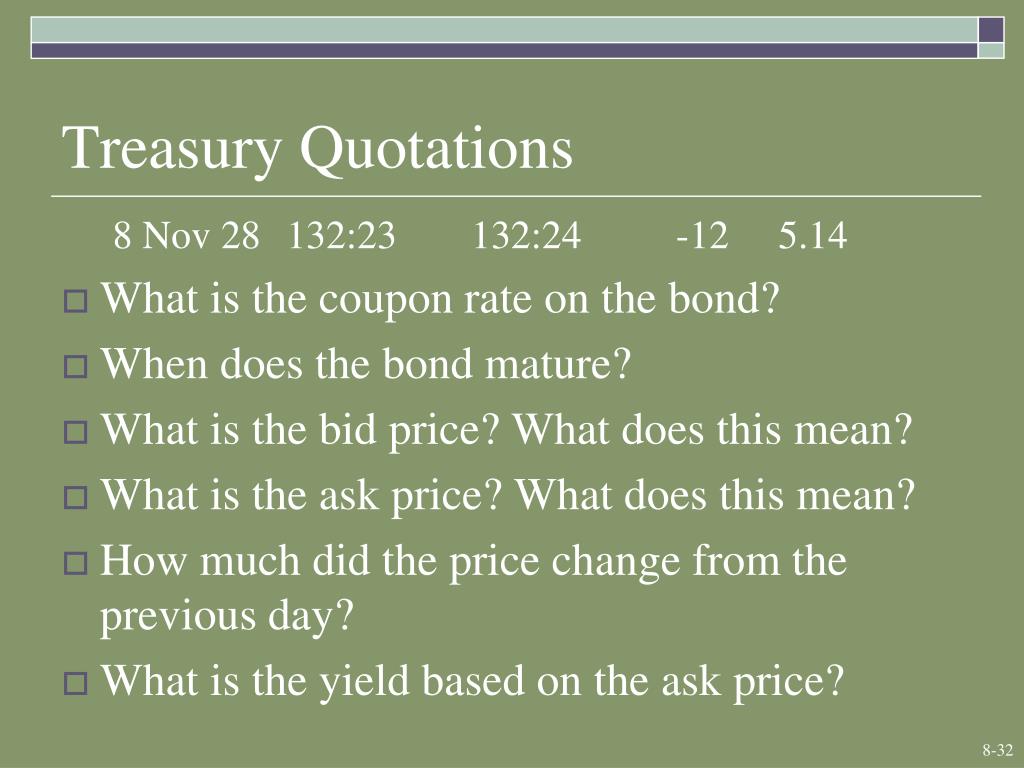

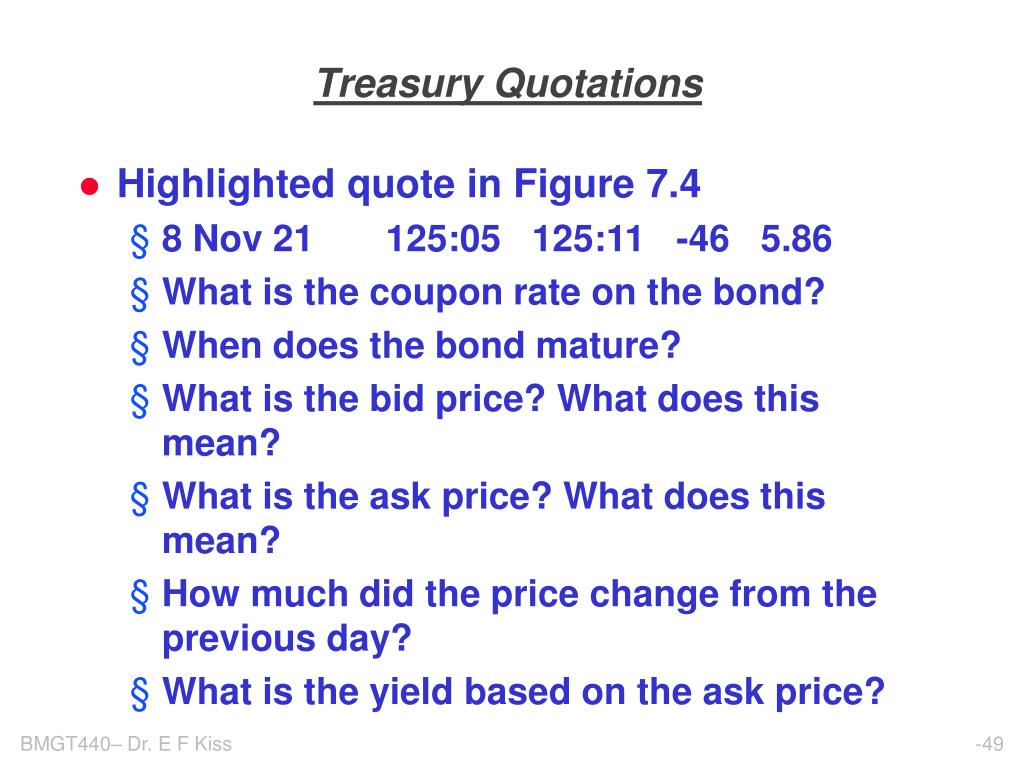

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Post a Comment for "38 what does coupon rate mean"