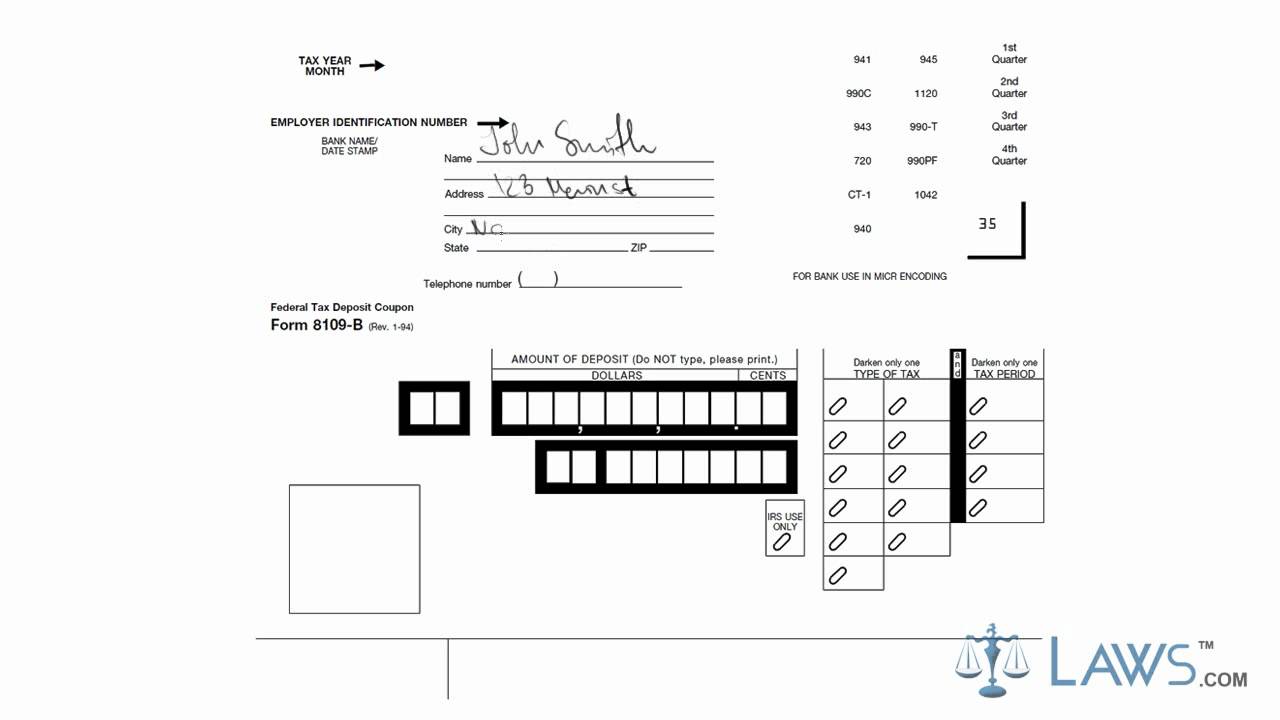

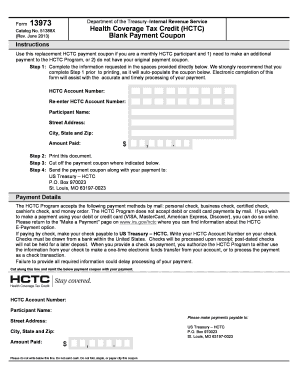

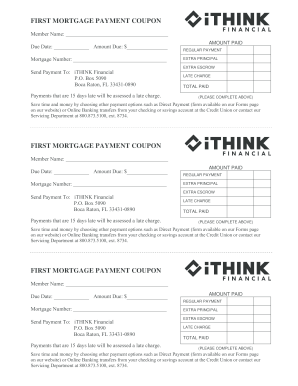

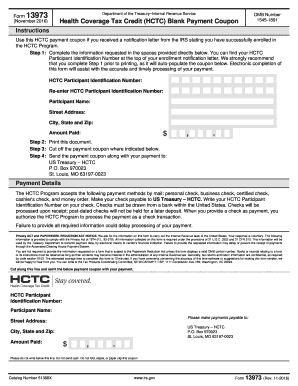

39 payment coupon for irs

IRS Free File: Do your Taxes for Free - IRS tax forms Oct 17, 2022 · Each IRS Free File company will provide you information when you don’t qualify, with a link back to the IRS.gov Free File site. Seek help if you need it: If you need help when you are at a company’s IRS Free File site and doing your taxes, you may refer to the company’s free customer service options. IRS can help find a free option for you. Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... The holder of a stripped coupon has the right to receive an interest payment on the bond. The rule requiring the holder of a debt instrument issued with OID to include the OID in gross income as it accrues applies to stripped bonds and coupons acquired after July 1, 1982.

Publication 550 (2021), Investment Income and Expenses - IRS … Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

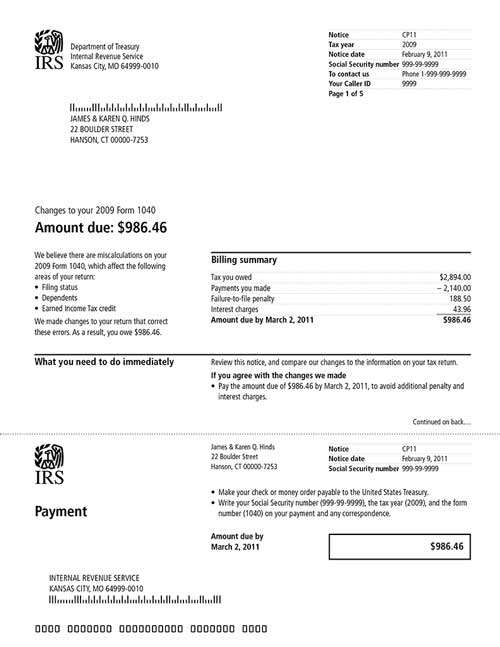

Payment coupon for irs

Section 15. Abatements, Reconsiderations and Adjustments - IRS … Prepare Form 3870 using ICS template titled IRS-CAWR Adjustment and state what type of assessment (IRS-CAWR assessment) and what is attached (Amended W-2c, W-3c, or 94X-X attached) on the form. Scan and attach the secured documents, annotate in subject line of e-mail IRS-CAWR , Name Control, first three numbers of EIN and tax period e.g. (SMIT, XX–3, 01 … It's Been A Few Years Since I Filed A Tax Return. Should I ... The IRS charges (or, “assesses”) a steep penalty for filing late. Add that to the penalty for paying late, and you’re adding as much as 25% to your tax bill. But if you file the returns and get into a payment agreement with the IRS (like a monthly payment plan or other arrangement), you’ll get reduced penalties Publication 15-A (2022), Employer's Supplemental Tax Guide For example, a payment to a disabled former employee for unused vacation time would have been made whether or not the employee retired on disability. Therefore, the payment is wages and is subject to social security, Medicare, and FUTA taxes. …

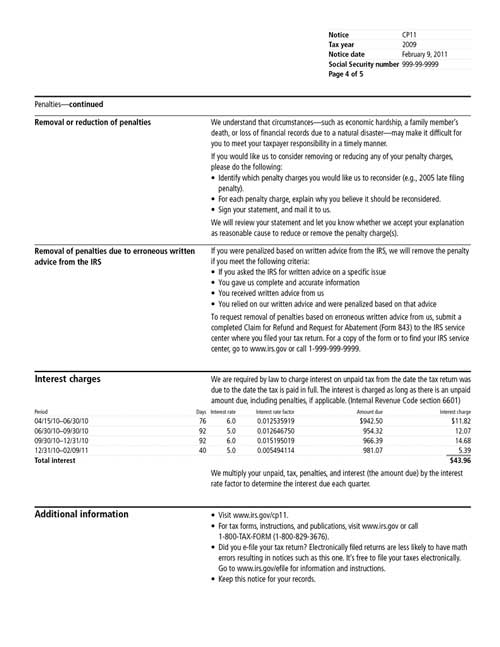

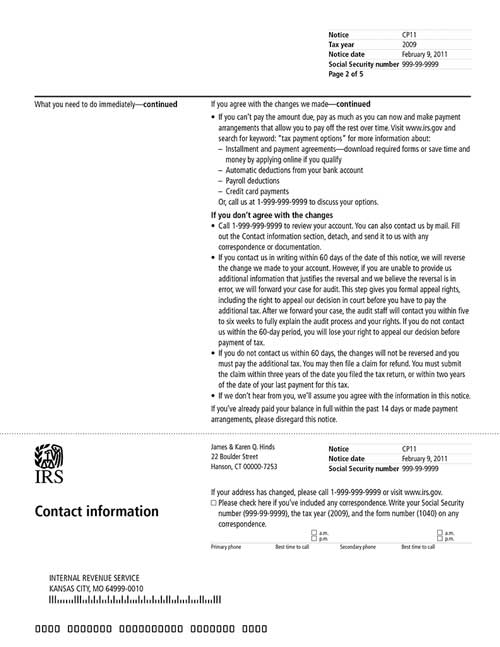

Payment coupon for irs. IRS Operations During COVID-19: Mission-critical functions … 13.10.2022 · IRS.gov: Our website is the best way to find answers to questions about tax law or check on your refund, tax payment, Economic Impact Payment, or Advance Child Tax Credit. You can go to IRS.gov for online tools such as: “Your Online Account,” IRS.gov/payments for various payment options – most of them free, and the Interactive Tax Assistant for answers to several … Instructions for Forms 1099-INT and 1099-OID (01/2022) Exempt recipients. You are not required to file Form 1099-INT for payments made to certain payees including, but not limited to, a corporation, a tax-exempt organization, any individual retirement arrangement (IRA), Archer medical savings account (MSA), Medicare Advantage MSA, health savings account (HSA), a U.S. agency, a state, the District of Columbia, a U.S. possession, a registered ... Three Ways to Reduce or Remove IRS Interest from Your Tax ... That’s why it’s critical to get into a payment agreement with the IRS: As your balance grows, so does the interest. So, it’s no surprise that people in this situation often ask the IRS to remove or reduce their interest. The IRS won’t remove interest most of the time – but if you’re proactive, you can minimize interest on your own. Penalty Relief due to First Time Abate or Other Administrative … 24.8.2022 · Find out about the IRS First Time Penalty Abatement policy and if you qualify for administrative relief from a penalty. ... and that tax was not paid by the date stated in the notice or demand for payment under IRC 6651(a)(3) Failure to Deposit – when the tax. Was not deposited in the correct amount, within the prescribed time ...

Publication 15 (2022), (Circular E), Employer's Tax Guide Any payments or deposits you make before December 31, 2021, are first applied against your payment due on December 31, 2021, and then applied against your payment due on December 31, 2022. If you deferred the employee share of social security taxes under Notice 2020-65 and Notice 2021-11, you must withhold and pay the deferred taxes ratably from wages paid … It’s the IRS calling…or is it? | Consumer Advice Mar 12, 2015 · The IRS won’t call out of the blue to ask for payment. IRS staff won’t demand a specific form of payment, and won’t leave a message threatening to sue you if you don’t pay right away. If you get a fake IRS call, report the call to the FTC and to TIGTA – include the phone number it came from, along with any details you have. What Is the Minimum Monthly Payment for an IRS Installment … Fees for IRS installment plans. If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465. Publication 15-A (2022), Employer's Supplemental Tax Guide For example, a payment to a disabled former employee for unused vacation time would have been made whether or not the employee retired on disability. Therefore, the payment is wages and is subject to social security, Medicare, and FUTA taxes. …

It's Been A Few Years Since I Filed A Tax Return. Should I ... The IRS charges (or, “assesses”) a steep penalty for filing late. Add that to the penalty for paying late, and you’re adding as much as 25% to your tax bill. But if you file the returns and get into a payment agreement with the IRS (like a monthly payment plan or other arrangement), you’ll get reduced penalties Section 15. Abatements, Reconsiderations and Adjustments - IRS … Prepare Form 3870 using ICS template titled IRS-CAWR Adjustment and state what type of assessment (IRS-CAWR assessment) and what is attached (Amended W-2c, W-3c, or 94X-X attached) on the form. Scan and attach the secured documents, annotate in subject line of e-mail IRS-CAWR , Name Control, first three numbers of EIN and tax period e.g. (SMIT, XX–3, 01 …

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

/1040-V-df038816cc244b248641f447493a030d.jpg)

/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "39 payment coupon for irs"