44 perpetual zero coupon bond

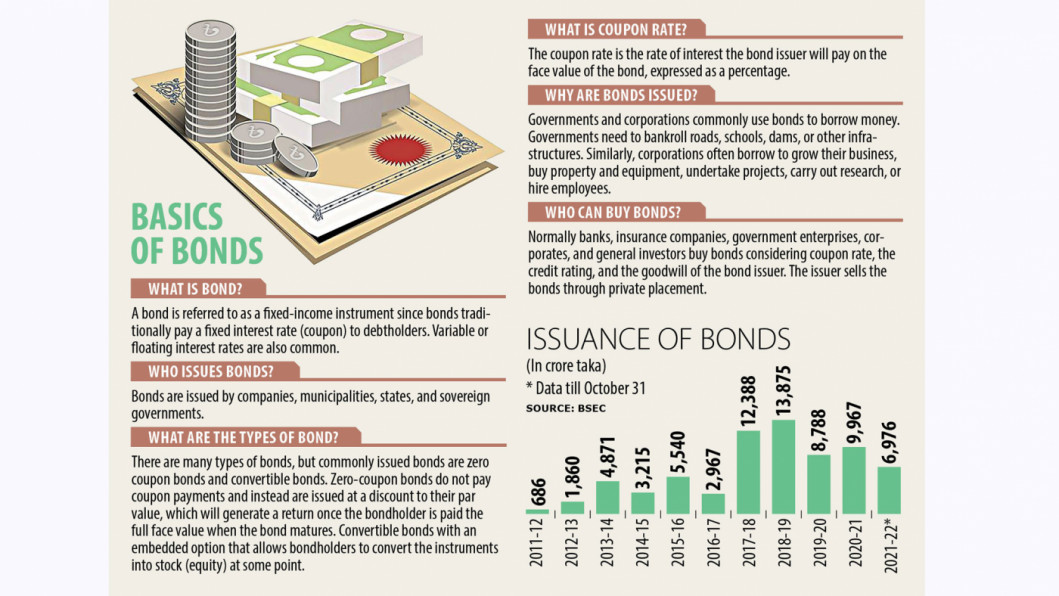

Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity … Bonds Home - Morningstar, Inc. Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information with real …

What Is an FHLB Bond? | Finance - Zacks Bond Types. Agency bonds are issued in a wide range of structures each defined by the originating institution. Structures might include a zero-coupon note that has a maturity date ranging from ...

Perpetual zero coupon bond

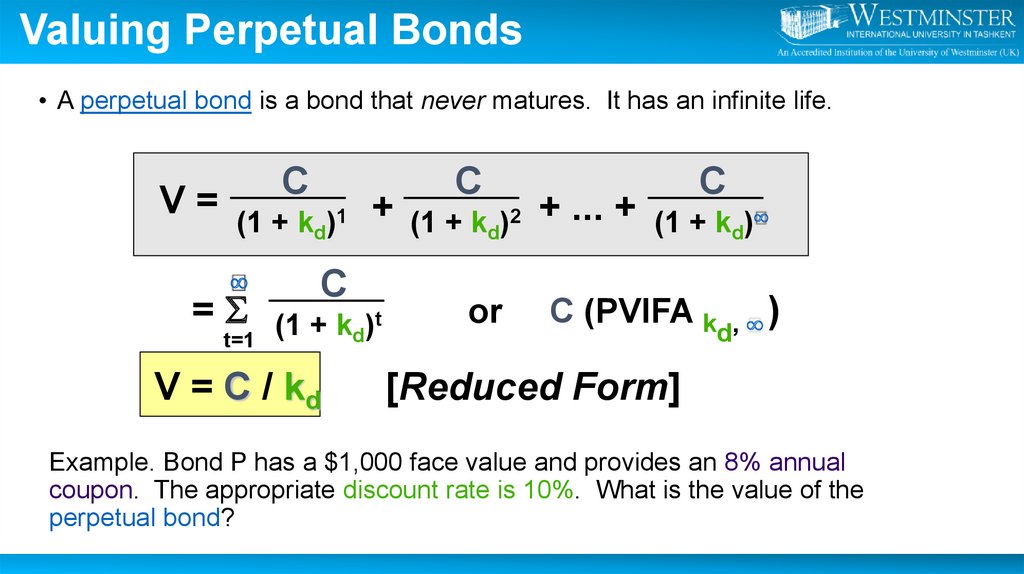

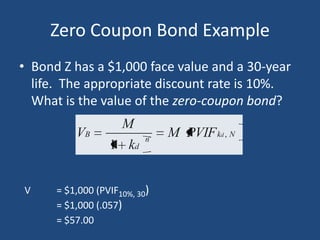

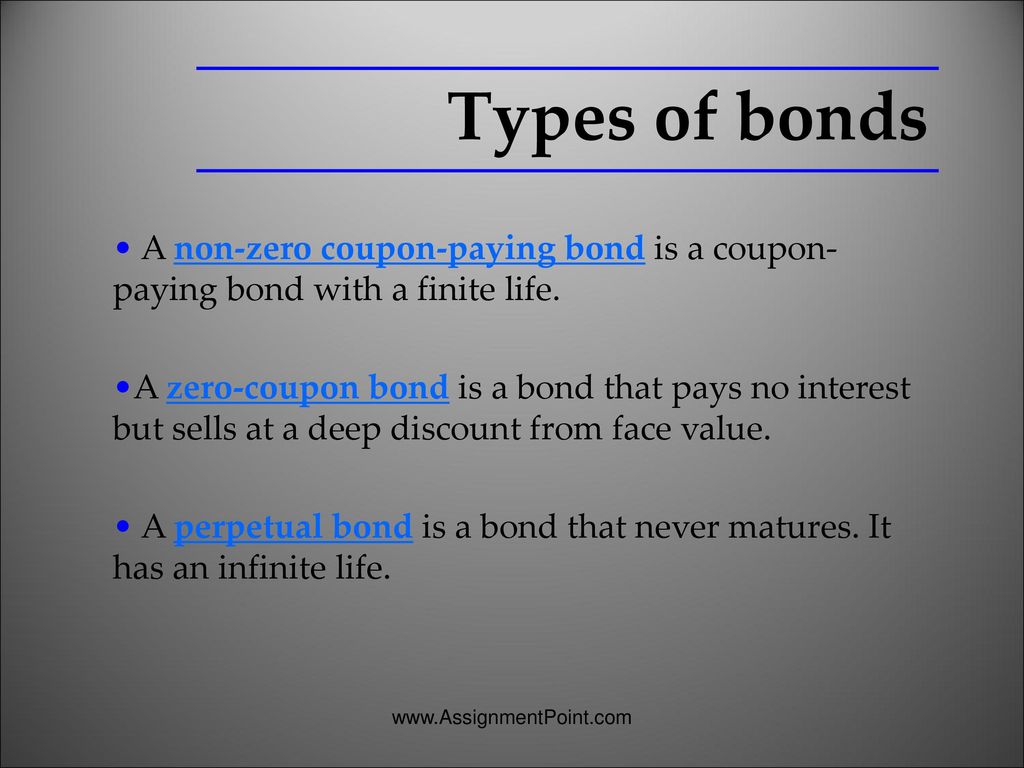

Perpetual Bond Definition - Investopedia 19.03.2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Zero coupon bonds are back in flavour. Will the party continue? 06.09.2022 · Zero coupon bonds are typically issued when the interest rates in the economy are high. These securities help in providing liquidity to bond issuers as they do not have to pay interest and ...

Perpetual zero coupon bond. finra-markets.morningstar.com › BondCenterBonds Home - Morningstar, Inc. Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information with real-time transaction prices for ... Invest in G-SEC STRIPS India - Bondsindia.com With G-STRIPS, investors can now get Zero Coupon Bond G-secs across the full maturity spectrum of G-secs issued by Government of India. A single cash flow from a STRIP means no coupons in between . No re-investment risk . Pricing of G-STRIPS. Each G-STRIP to be priced as a ZCB. Transactions take place at the yield (to 4 decimals) agreed by the buyer and the seller. … › news › businessZero coupon bonds are back in flavour. Will the party continue? Sep 06, 2022 · The difference between the issue price and the maturity value of the zero coupon bond is the capital gain for the investor. ... Canara Bank to issue perpetual bonds, say traders. Yield curves - ECB Statistical Data Warehouse - Europa Selection of Bonds: Only fixed coupon bonds with a finite maturity and zero coupon bonds are selected, including STRIPS. Perpetual bonds and variable coupon bonds, including inflation-linked bonds, are not included. In order to reflect a sufficient market depth, the residual maturity brackets have been fixed as ranging from three months up to and including 30 years of …

en.wikipedia.org › wiki › Zero-Coupon_InflationZero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon. › bondsSecondary Bonds Market – Types of BondsIndia You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds. › gstripsInvest in G-SEC STRIPS India - Bondsindia.com The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond? efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

Zero coupon bonds are back in flavour. Will the party continue? 06.09.2022 · Zero coupon bonds are typically issued when the interest rates in the economy are high. These securities help in providing liquidity to bond issuers as they do not have to pay interest and ... All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Perpetual Bond Definition - Investopedia 19.03.2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "44 perpetual zero coupon bond"