44 treasury bonds coupon rate

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Treasury Bonds | CBK May 16, 2022 · FIVE AND TEN-YEAR FIXED COUPON TREASURY BONDS ISSUE NOS. FXD 1/2011/5 AND RE-OPENING OF ISSUE NO. FXD 2/2010/10 DATED 31/01/2011: 07/12/2010: ... Find the bond’s coupon rate, maturity date and issue date using our Treasury Bonds Results table above. You’ll find a full schedule of the bond’s interest payments in its prospectus, which …

Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Treasury bonds coupon rate

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The... How Is the Interest Rate on a Treasury Bond Determined? A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments remain... Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run returns of U.S. Treasuries. ... Prices of …

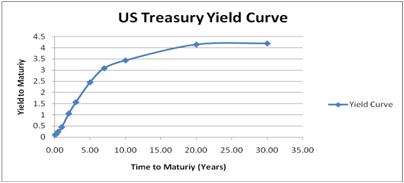

Treasury bonds coupon rate. Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. How to Buy Treasury Bonds - TheStreet Feb 25, 2019 · There are occasionally auctioned 10-year "zero-coupon" bonds, which mature in 10 years but pay no interest. The price and yield of any particular Treasury bond are determined at … Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Individual - TIPS: Rates & Terms - TreasuryDirect Follow the link and locate the Index Ratio that corresponds to the interest payment date for your security. Multiply your original principal amount by the Index Ratio. This is your inflation-adjusted principal. Multiply your inflation-adjusted principal by half the stated coupon rate on your security (i.e., 2%).

Bangko Sentral ng Pilipinas Default.aspx TREASURY BONDS : coupon rate per instrument in percent per annum : for the periods indicated : Auction Date: 2-Year: 3-Year: 5-Year: 7-Year: 10-Year: 20-Year : 21-Jun-22: 7.250 : 14-Jun-22: 6.500 : 7-Jun-22: 6.250 : 31-May-22 ... a 5.5-year retail treasury bond: Source: Bureau of the Treasury ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data. View the ... Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). ... TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot ... Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

Statement by Secretary Yellen on President Biden ... - home.treasury.gov WASHINGTON - Today, at the G7 Leaders' Summit in Germany, President Biden and fellow G7 Leaders formally launched the Partnership for Global Infrastructure and Investment (PGII), a values-driven, high-standard, and transparent partnership to meet the enormous infrastructure needs of low- and middle-income countries without trapping them in cycles of debt. PGII will mobilize billions of ... › us-treasury-bondsUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. › terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Treasury Bonds Rates - WealthTrust Securities Limited A Treasury Bond (T-Bond) is a zero default-risk, extremely liquid medium to long term debt instrument issued by the CBSL which consists of maturity period ranging from 2 to 25 years with semiannual coupon payments. ... Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium ...

Bonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The …

Treasury Bonds | AOFM Treasury Bonds are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security, payable semi-annually. Indicative yields for Treasury Bonds are published by the Reserve Bank of Australia. Treasury Bond lines Information Memorandum Pricing Formulae Market makers

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. ... The coupon rate can vary depending upon the structure of the ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

› res_tbond_ratesIndividual - Treasury Bonds: Rates & Terms Aug 15, 2005 · Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.)

en.macromicro.me › collections › 51Fed Funds Rate vs. US Treasury Yields | U.S. Treasury Bond ... Save US 10-year T-Note Auction Coupon Rate. The coupon rate is viewed as the fundamental costs of buying bonds. When auction coupon rate is low, demand for bonds could be huge, which leads to an increase in bond price. When coupon rate remains high, bond price falls.

Individual - Treasury Bonds: Rates & Terms Aug 15, 2005 · Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. ... Interest Coupon Rate Price Explanation; Discount (price below par) 30-year bond Issue Date: 8/15/2005: 4.35%: 4.25%: 98.333317:

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run returns of U.S. Treasuries. ... Prices of Fixed-Rate Bonds Fall," Pages 1-2 ...

home.treasury.gov › services › bonds-and-securitiesBonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The Bureau of the Fiscal Service The Bureau of the Fiscal ...

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

Fixing of Coupon Interest Rate Announcement no. 79/2022. Fixing of Coupon Interest Rate. Interest rate for Jyske Realkredit's: Series 422.E.Cb3 ju23 RF with ISIN DK0009397499 has per 1 July 2022 and until and including 30 ...

Treasury Bonds | CBK This calculator allows you determine what your payment would be based on the bond's face value, coupon rate, quoted yield and tenor. This calculator allows you to determine the price of a bond that is re-opened or sold on the secondary market. Find the bond's coupon rate, maturity date and issue date using our Treasury Bonds Results table ...

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury …

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

:max_bytes(150000):strip_icc()/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

:max_bytes(150000):strip_icc()/shutterstock_727670.bearer.bond.cropped-5bfc3069c9e77c005180aeaa.jpg)

Post a Comment for "44 treasury bonds coupon rate"