42 government zero coupon bonds

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

How Do Zero Coupon Bonds Work? - SmartAsset Zero coupon bonds can be issued by f inancial institutions, c orporations, and f ederal agencies or municipalities. Some of those bonds are initially issued as zero coupon bonds. Others become zero coupon bonds only after a financial institution strips them of their coupons and repackages them. And you still pay taxes on the money you earn from ...

Government zero coupon bonds

Where can I buy government bonds? - Investopedia Nov 30, 2021 · Yields on government bonds range from approximately 2.20% to 3.00%. Many investors look to government bonds as options for consideration along with money market accounts, certificates of deposit ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. Bonds - Overview, Examples of Government and Corporate Bonds The U.S. government’s debt is considered risk-free for this reason. 2. Treasury bills. Maturity < 1 year . 3. Treasury notes. Maturity between 1-10 years . 4. Treasury bonds. Maturity > 10 years . 5. Zero-coupon bond. Zero-coupon bonds make no coupon payments but are issued at a discounted price. 6. Municipal bonds. Bonds issued by local ...

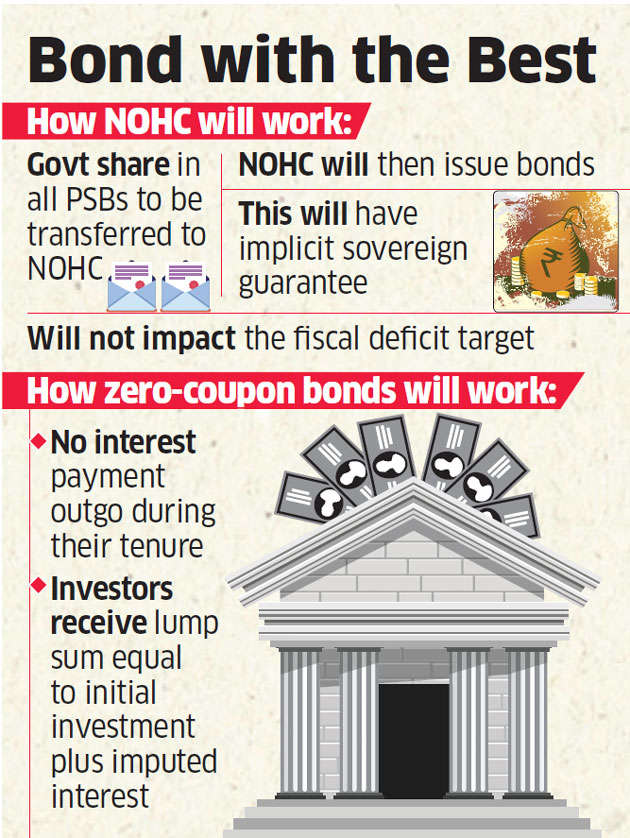

Government zero coupon bonds. Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond fund is a fund that contains zero coupon bonds. Zero coupon bonds don't pay interest, but they are purchased at a steep discount and the buyer receives the full par value upon maturity. Zero coupon bond funds can be structured as a mutual fund or an ETF. Zero coupon bonds typically experience more price volatility than other ... Institutional - STRIPS - TreasuryDirect For further information on the tax treatment of STRIPS and other zero-coupon securities, see Internal Revenue Service Publication 550, "Investment Income and Expenses." Valuation Guidance for Government Agencies. Principal Payment. The stripped principal component of a security will be recorded at book value. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... What are Zero coupon bonds? - INSIGHTSIAS What are Zero coupon bonds? Context: The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par. These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par.

Zero Coupon Bond Yield: Formula, Considerations, and ... Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ... b) Mr James Lucky, a British investor, is considering ... Transcribed image text: b) Mr James Lucky, a British investor, is considering a five-year investment on zero-coupon government bonds. Currently, the annual yield to maturity of British, German and Chinese zero-coupon government bonds maturing in five years is 3%, 5% and 7%, respectively.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. Zero Coupon Bond - WallStreetMojo Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn't involve any cash flow during ... Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon government bonds can be purchased directly from the Treasury at the time they are issued. After the initial offering, they can be purchased on the open market through a brokerage account . What Is a Zero-Coupon Bond? Definition, Advantages, Risks The US federal government, various municipalities, corporations, and financial institutions all issue zero-coupon bonds. The majority — what most people refer to as zeros — are US Treasury issues.

Brain Booster for UPSC & State PCS Examination (Topic: Zero Coupon Bonds) | Dhyeya IAS® - Best ...

List of government bonds - Wikipedia TEC10 OATs - floating rate bonds indexed on constant 10year maturity OAT yields; OATi - French inflation-indexed bonds; OAT€i - Eurozone inflation-indexed bonds; Agence France Trésor Germany. Issued By: German Finance Agency, the German Debt Agency Bunds. Unverzinsliche Schatzanweisungen (Bubills) - 6 and 12 month (zero coupon) Treasury ...

Modi Government: Zero-Coupon Bonds, holding co may help raise Rs 1.35 lakh crore - The Economic ...

What is the difference between a zero-coupon bond and a ... A zero-coupon bond issued by a U.S. local or state government entity is another alternative. All interest on these municipal bonds, including imputed interest for zero-coupon bonds, is free from...

Understanding Zero Coupon Bonds - Part One Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value

What Is a Zero Coupon Bond? | The Motley Fool In contrast, with a zero coupon bond with a face value of $100, paying 3%, you buy the bond for $74.41. You then wait 10 years, and at the end of those 10 years, the company pays you $100.

Government - Continued Treasury Zero Coupon Spot Rates* 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ...

Government, Zero-Coupon & Floating-Rate Bonds - Video ... Treasury bonds are issued for 30 year terms and have a coupon payment, or interest payment, every six months. Payments continue for the 30 year duration, at which point the government pays the face...

What Is a Zero-Coupon Bond? | The Motley Fool Finally, although also similar to regular bonds, zero-coupon bonds can either be government-issued, corporate, or municipal. Depending on the issuer, zero-coupon municipal bonds may generate tax ...

United Kingdom Government Bonds - Yields Curve May 13, 2022 · The United Kingdom 10Y Government Bond has a 1.746% yield.. 10 Years vs 2 Years bond spread is 50.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022).

Post a Comment for "42 government zero coupon bonds"